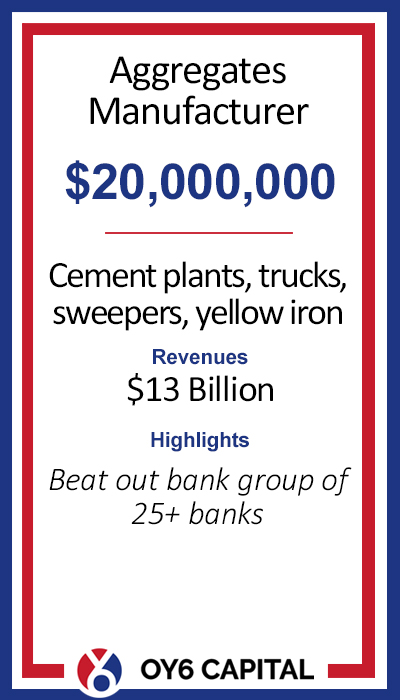

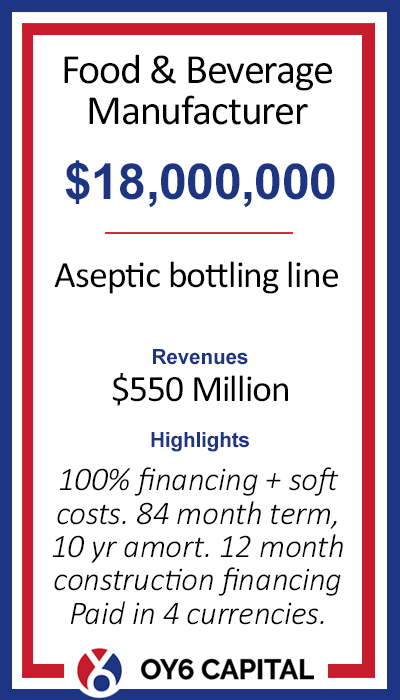

Capital to Put Expansion Plans In Motion

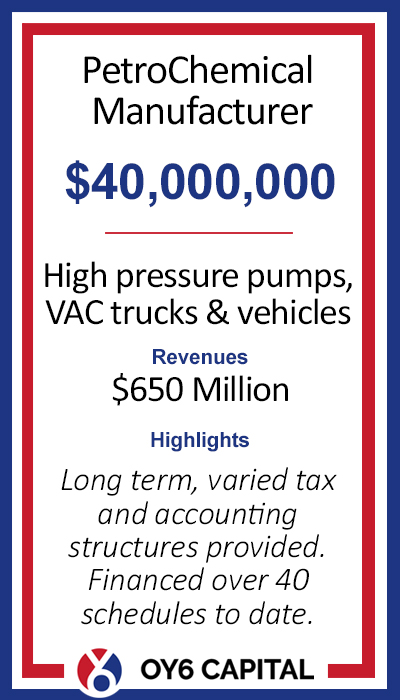

When it comes to investing in expansion, many lenders are only interested in funding limited parts of your overall need. OY6 is able to fund a broader range of equipment, assets, and soft costs to help you preserve cash at a low cost of funds.